Recession-Hammered, Now on Recovery Road

I just publised this article on NE Minnesota’s rebounding construction sector in August’s Minnesota Employment Review:

I just publised this article on NE Minnesota’s rebounding construction sector in August’s Minnesota Employment Review:

Real (inflation adjusted) Gross Domestic Product (GDP) in the Duluth-Superior Metropolitan Statistical Area (MSA) declined between 2011 and 2012 according to data released yesterday by the U.S. Department of Commerce’ Bureau of Economic Analysis. GDP is a measure of total income earned domestically, and total expenditure on domestically produced goods and services. According to the data, GDP in the MSA (which includes all of St. Louis and Carlton counties in Minnesota, and Douglas County in Wisconsin) declined 2% dropping by $167 million from $8,539,000,000 in 2011 to $8,372,000,000 in 2012. The decline comes on the tail of three years of growth that saw area GDP grow by 4% between 2009 and 2011.

The overall decrease in GDP was the result of sizable drops in two industry sectors – Natural Resources and Mining and Financial Activities – and a small drop in education and health services. Natural Resources and Mining declined by 16% from $319 million to $268 million and Financial Activities dropped by 18% from $1.1 billion to $934 million. Solid gains were posted every other sector led by Professional, Scientific, and Technical Services (+3%), Construction (+7%), Wholesale Trade (+7%), Arts, Entertainment, and Recreation (+8%), Information (+7%), and Manufacturing (+2%).

While the decline in GDP is concerning — 305 of the nation’s 381 metropolitan areas saw economic growth between 2011 and 2012, including the other Minnesota MSAs — it is largely out of our control. In a mining sector that has added almost 1,500 jobs across the Iron Range since 2009, more than tripling its GDP between 2009 in 2011 in the process, the sudden drop seems to be an anomaly. The reasons behind it are complicated, but it probably comes down to international market and export trends. If international demand for iron ore drops (which it did), it is unfortunately going to adversely impact our GDP numbers here in northern Minnesota.

*Authors note – I have updated the numbers in this post after inadvertently using nominal GDP numbers initially. Real GDP is inflation adjusted (chained to 2005 dollars) and is a better way to judge change over time.

The Duluth News Tribune has reported that Kemp’s has announced a 35 employee lay-off from Duluth’s Franklin Foods milk processing facility. The company line from Kemp’s is that a drop in milk consumption has led the company to consolidate their milk processing operation to the Twin Cities and Rochester facilities.

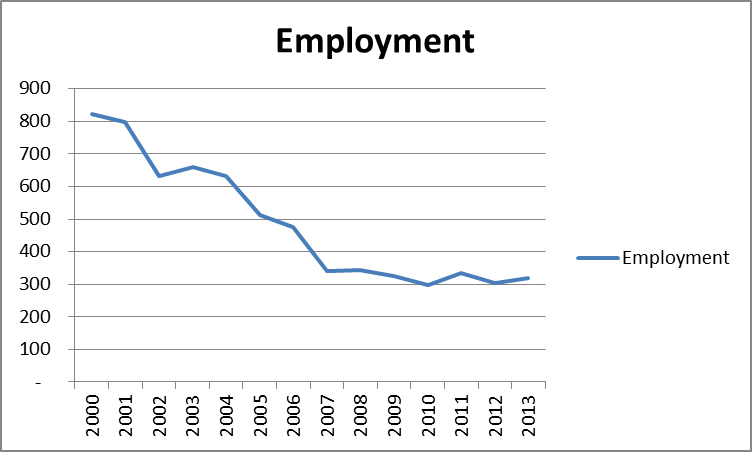

The lay-offs at Franklin Foods are a continuation of a long trend of decline in the Northland’s food production sector. According to Quarterly Census of Employment and Wages (QCEW) statistics, there were 807 people employed in the Food Manufacturing sector in Northeast Minnesota in 2000 – by the first quarter of 2013 that number had dropped by 61% to 319.

While the lay-offs are tragic, the question that begs to be answered here is why are people drinking so much less milk?

Exciting news! 1st quarter 2013 Quarterly Census of Employment and Wages (QCEW) data released last week contained good news for the Northland. The QCEW tool tracks wages and employment by industry at the state, regional, county and municipal levels. QCEW data, which are available on a quarterly and annual basis, are a comprehensive and accurate source of employment and wage information and a key component in many economic research projects.

Seven-County Arrowhead Region

From the 1st quarter of 2012 to the 1st quarter of 2013, employment in the seven-county arrowhead region grew by 2% as 2,267 jobs were added to the economy. The 2% rate of growth is the highest 1st quarter to 1st quarter rate of growth since the economy bottomed out in 2009. Sixteen of the twenty major industry sectors saw quarter to quarter employment gains. Job losses were limited to Agriculture, Forestry, Fishing, and Hunting (3%); Manufacturing (1%), Educational Services (1%); and Arts, Entertainment and Recreation (3%). Industries that saw the biggest gains were clustered in the Information, Financial Services, and Professional and Business Services sectors. The biggest gains were made in Professional, Scientific, and Technical Services, which grew by 14%; Real Estate and Rental and Leasing (9%); Administrative and Support and Waste Management and Remediation Services (6%); Transportation and Warehousing (6%); Information (5%); Construction (4%); and Other Services (4%).

Duluth

Duluth also saw quarter to quarter employment gains as employment in the city grew by 3% or 1,540 jobs. Duluth saw significant gains in Information which grew by 21% adding 180 jobs; and Professional, Scientific, and Technical Services which grew by 20% adding 387 jobs. Other sectors posting significant gains include Other Services (11%); Wholesale Trade (6%); Transportation and Warehousing (7%); Administrative and Support and Waste Management and Remediation (7%); and Accommodation and Food Services (7%).

While the decline in manufacturing jobs across the Northland is disappointing, total manufacturing employment across the region is still up 11% from the post-recession low of 7,890 jobs in the first quarter of 2010.

I’m just digging into the data, so stay tuned for further analysis!

Here is the July installment of the Monthly Labor Market Update, enjoy!

Current Employment Statistics (CES) update:

Local Area Unemployment Statistics (LAUS) Update:

The state-wide press release is available here.

A recent report by Wells Fargo claimed that Duluth’s recovery from the recession will remain relatively “tenuous” as the city fails to keep pace with the job growth of the state and nation. The report derives its conclusions from Current Employment Statistics (CES) data for the Duluth-Superior Metropolitan Statistical Area – an area as large as it is diverse, covering St. Louis and Carlton counties in Minnesota, and Douglas County in Wisconsin. St. Louis County itself is larger than some states, and contains several autonomous cities and vast stretches of wilderness stretching to the Canadian border. Frankly, making claims about Duluth using statistics from the MSA, and vice versa, is like using nationwide statistics to describe the economy of one state – or extrapolating conclusions about the economy of a single state from nationwide statistics.

Some in Duluth are concerned about researchers making claims about Duluth using statistics from the MSA as a whole. Interestingly enough, close inspection of the numbers indicate that it actually seems to be greater St. Louis County (minus Duluth) that is driving regional job growth. According to Quarterly Census of Employment and Wages (QCEW) data, since 2009 employment in St. Louis County outside of Duluth has increased by 4%, while employment in Duluth proper has decreased by 1%. Industries doing particularly well outside of Duluth include Natural Resources and Mining which grew by 33%, Manufacturing which grew by 31%, and Construction which grew by 8%. Manufacturing and Construction both saw declines in employment in Duluth. While Mining employment did see increases, the number of jobs (45) is rather insignificant compared to the rest of the county. Duluth was also outpaced by the rest of the county in Education and Health Services employment growth. While employment in the industry held steady in Duluth between 2009 and 2012, the rest of the county saw 3% employment growth.

With that said, the claim in the report that Education and Health Services employment has been “stuck in neutral” in Duluth is somewhat misleading. According to Current Employment Statistics (CES) data, which includes the entire MSA, Educational and Health employment has actually increased by 7% between June ’09 and June ’13. Although the majority of this growth has occurred outside of Duluth proper, it does not seem “stuck in neutral” when you consider the state’s growth in the industry was only 1% higher. It initially seemed that the Wells Fargo report was using QCEW data to make this claim – and if this was the case it would make sense, but since they use CES data for their Total Non-Farm Employment numbers, this seems unlikely. So while they write about an industry stuck in neutral, the data indicates an industry that is expanding throughout the region, and creating jobs outside of Duluth.

Frustrations around the report are a little clearer when the unemployment rate is considered. Cities such as Virginia and Hibbing still have relatively high unemployment at 7.9% and 8.6% respectively, which drives up the unemployment rate of the MSA as a whole to 6.6%. Duluth itself actually has an employment rate of 5.9%, only 0.7% behind the state’s rate of 5.3%. So while the job growth might be happening elsewhere – the low unemployment rate in Duluth indicates a fairly healthy labor market, and recent CES data shows job growth may be returning.

Again, most of the confusion (and frustration) surrounding this report comes from the fact that the Duluth-Superior MSA is not a contiguous metro area. It is hard to analyze the MSA as one region when it so large and is comprised of relatively autonomous cities and economies. With that said, the picture is not as bad as the report indicates. Job growth in rural areas and low unemployment in Duluth indicate an economy that is turning the corner.

Hey Folks, sorry for the lengthy absence; the economy never sleeps, and i’ve been busy tracking it’s every movement. Anyway, the past week week has seen the release of the most recent labor market information including Current Employment Statistics (CES), and Local Area Unemployment Statistics (LAUS). Here are a few of the highlights as they pertain to the Northland for your reading pleasure:

Here in the Northland, healthcare is big business. Home to Essentia Health and St. Luke’s, Duluth has cultivated a strong healthcare cluster that has influence throughout the upper Midwest. Essentia’s network extends throughout Minnesota, Wisconsin, North Dakota, and even into Idaho, while St. Luke’s has grown from a single hospital to a network of 38 primary and specialty clinics throughout Northeastern Minnesota, Northwestern Wisconsin, and the Upper Peninsula of Michigan.

According to Quarterly Census of Employment and Wages (QCEW) data, in 2012 there were 32,572 jobs in the healthcare and social assistance sector throughout the seven county arrowhead region; this number accounts for 24% of all regional employment! If that weren’t enough, according to DEED’s employment projections, by the year 2020 the sector is expected to grow by an additional 33.3%. Within the sector the largest employers are, not surprisingly, hospitals (10,970) and nursing and residential care facilities (10,010). With location quotients* of 1.86 and 2.54 respectively, these two subsectors have become highly specialized in the region, and are important drivers of local economic growth.

Partly because of the strong healthcare cluster in the region, residential care facilities for aging seniors are becoming an increasingly important sub-sector in the region. This past week the Duluth News Tribune reported that a Bethesda, MD based company completed a $51 million purchase of eleven assisted living facilities throughout the Northland. The company, Northstar Realty Finance, will lease the properties to another Maryland based business, Meridian Senior Living, which will operate the facilities. Beyond looking for a presence in Minnesota, Meridian has plans to expand their operation. The company is looking to meet increasing demand by adding 10-20 more facilities, each with 30-60 employees, over the next 5-10 years. This is not a unique story. As the baby boomer generation reaches retirement and beyond, the demand for quality residential care facilities will continue to expand across the region.

From certified nursing assistants and registered nurses to administrators to social and human and service assistants, residential care facilities offer a wide range of jobs for all educational backgrounds. Social and Human Service Assistants help elderly facility residents access the social services they need on a daily basis. While the job is located in the Human Services career cluster, many social and human services assistants find employment at residential care facilities working with the elderly. According to iSeek, the median pay for this job is $13.95/hour. While this is on the lower end of the pay spectrum, the occupation has a projected job growth of 25.5%, making it one of the more in demand occupations in Northeast Minnesota. Social and human service assistants who conduct clerical work need a high school diploma; those that wish to work with clients need some sort of college level training. According to iSeek, Certificates or degrees in social work, psychology, sociology, human services, or gerontology are favored.

Those interested in breaking into a healthcare career may be interested in becoming a Certified Nursing Assistant (CNA). CNAs generally complete formal training in High School, technical school, or a two-year college. According to iSeek, CNAs check with the supervising nurse for instructions about each patient, and may explain some medical instructions to patients and family members. The median wage for a CNA is $12.94 per hour. CNA employment is expected to grow by 25.5% across the arrowhead by 2020.

Those looking to take the next step in the field may be interested in a career as a Registered Nurse (RN). With a median wage of $34.42 an hour, RNs are paid well above the statewide average. It is also a growing career field; by 2020 there is projected to be 5,086 RN jobs in Northeast Minnesota, a 19.9% increase over 2010 numbers. According to iSeek, there are three ways to become an RN. You can get an associate’s degree in nursing at a two-year college, a bachelor’s of science in nursing from a four-year college, or a diploma, for which hospitals offer two to three year programs.

For those looking for a first career, or others looking to make a career change, the health care sector in Northeast Minnesota offers abundant opportunities across many career fields. Already one of the largest employers in the region, strong projected future growth will ensure that this industry is a strong employer for years to come.

*Location quotients are basically an indicator of area specialization. An LQ greater than 1 indicates a greater concentration of a particular industry as compared to that industry concentration nationally. Make sense? If not shoot me an e-mail and I’ll explain further!

Continued job growth in Northeast Minnesota has led to a decrease in the regional unemployment rate to 6.7% – the 5th consecutive month of declining unemployment across the Arrowhead region. Down from 7.1%, the decreased rate is due in part to private sector job growth in the Duluth-Superior MSA which grew by 2,023 jobs over the course of the previous month according to the Minnesota Department of Employment and Economic Development’s Current Employment Statistics. While the downward trend is a good thing, the unemployment rate in Northeast Minnesota is still the highest in the state – significantly higher than the statewide unemployment rate of 4.9%.

The decreasing rate indicates increasing confidence in the economy as more individuals who had given up the job search are returning to the labor market and successfully finding employment. From April to May, labor force participation increased from 168,133 to 168,958. This is in large part to a marked increase in seasonal workers arriving to support the advent of the tourist season, and is in line with historical employment cycles for the region. While the unemployment rate at this time last year was lower (6.4%), this is largely due to the late arrival of spring in the Northland this year. If the Northland hadn’t received the lousy weather it did in May and early June, the decrease in unemployment could have been greater.

Northeast Minnesota unemployment numbers are still relatively high in part because of high unemployment in Koochiching County. With an unemployment rate of 9%, Koochiching County is second only to Clearwater County (10.7%) for the highest in the state. Unfortunately, Koochiching County’s employment woes are bound to get worse as layoffs at the Boise Inc. Paper Mill in International Falls take effect. Last month Boise announced plans to shutter two of its plants, eliminating 265 jobs in the process.

While the numbers are trending in the right direction, there is still a ways to go to get the regional economy back to a healthy level of unemployment. Upticks in total employment in the manufacturing, mining, and construction sectors will no doubt help, but we still need people to fill the positions being created.